New England country bank note issues circulated widely in Boston. In 1824, six Boston banks joined with the Suffolk Bank of Boston to create a system for presenting country banks with their notes in volume, thus forcing them to hold higher reserves of specie. Soon after, the country banks agreed to keep deposits in the Suffolk Bank, resulting in the first arrangement for a clearing house for currencies of remote banks.

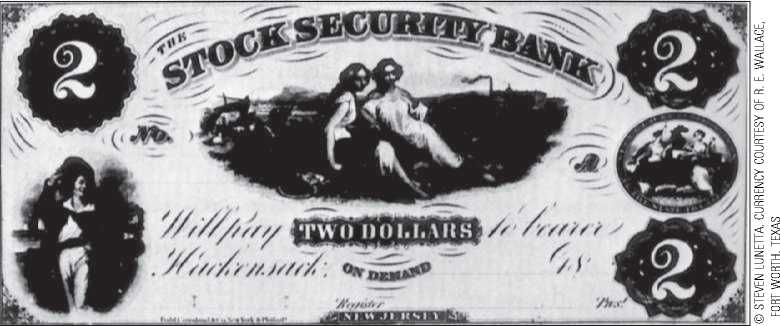

A note issued by one of New Jersey’s free banks. The bank’s name stresses the point that the note is backed by government bonds (stocks).

These deposits, a cheap source of funds, helped make the Suffolk Bank one of the most profitable in the country. The other Boston banks shared in this profit through their ownership of Suffolk stock, so the arrangement was hardly altruistic. As a result, however, the prevailing discounts on New England country bank notes in Boston fell. By 1825, country notes passed through the Suffolk system at par. New England was blessed with a uniform paper currency.

The Suffolk Bank continued as the agency for clearing New England notes until 1858, when some new Boston banks and some country banks that resented the dictatorial policies of the Suffolk Bank organized a rival institution. During the Civil War, federal legislation did away with state bank notes and the need for such regional systems, but the Suffolk system was the predecessor to the modern practice of requiring reserve deposits of member banks in the Federal Reserve System.

World History

World History